February 23, 2023

E8 Trader Funding Overview

E8 Funding provides innovative funding solutions for Forex and CFD traders worldwide. E8 Funding strives to provide unique funding opportunities that make it easy to be a professional funded trader and manage the capital remotely from around the globe.To get more news about e8 funding review, you can visit wikifx.com official website.

E8 Funding created a user-friendly interface that provides all the information traders need and uses the industry's most advanced technology. As a result, their traders have access to liquidity at tier-1, aiming to become the best proprietary trading company in the world. In addition, E8 hopes to offer its traders the best funding experience with innovative ideas.

Impossible to review the E8 trader funding program without sounding like an infomercial. It just might be the best in the industry across the trader funding industry for all products and types. You can also become a senior trader at a prop firm by moving up the ladder in a scalable funded account that rewards success.

You can be trading a funded account as quickly as three days, and the fee is refundable. That is correct; you can be trading a funded account with a $20,000 drawdown in as quick as three days and get your fee refunded. E8 funding also offers a scalable account to scale a funded account up to $1,000,000.

You can trade currencies, world indexes, metals, crypto, and even stock prices all under one account. Perhaps it should also be mentioned that you can trade VIX, Turkish Lira, and other instruments in the world spotlight for extreme moves.First months of 2022 have been very volatile and put many funded trader programs in some difficulty. It was important to monitor how companies performed. E8 did great introducing new features and continuing fast account processing and timely payouts.

Out of nowhere E8 surprised all traders with all new Account scaling for regular funded accounts. Traders start out with 8% overall drawdown.

With each withdrawal (8 days first withdrawal, every 2 weeks after) traders are rewarded with 1 additional % in drawdown until account drawdown reaches 14%. That means $250,000k account with first 6 withdrawals gets extra $2,500 in drawdown each

Automated Payout System

E8 was already leader in this space. Traders could pass evaluation in a single day and start live trading in about a day thanks to extremely hard working support and trader processing team. First withdrawal industry leading 8 Days after first trader. Now they have added simple system where traders are able to request payouts from trader dashboard.

Posted by: freeamfva at

08:28 AM

| No Comments

| Add Comment

Post contains 430 words, total size 3 kb.

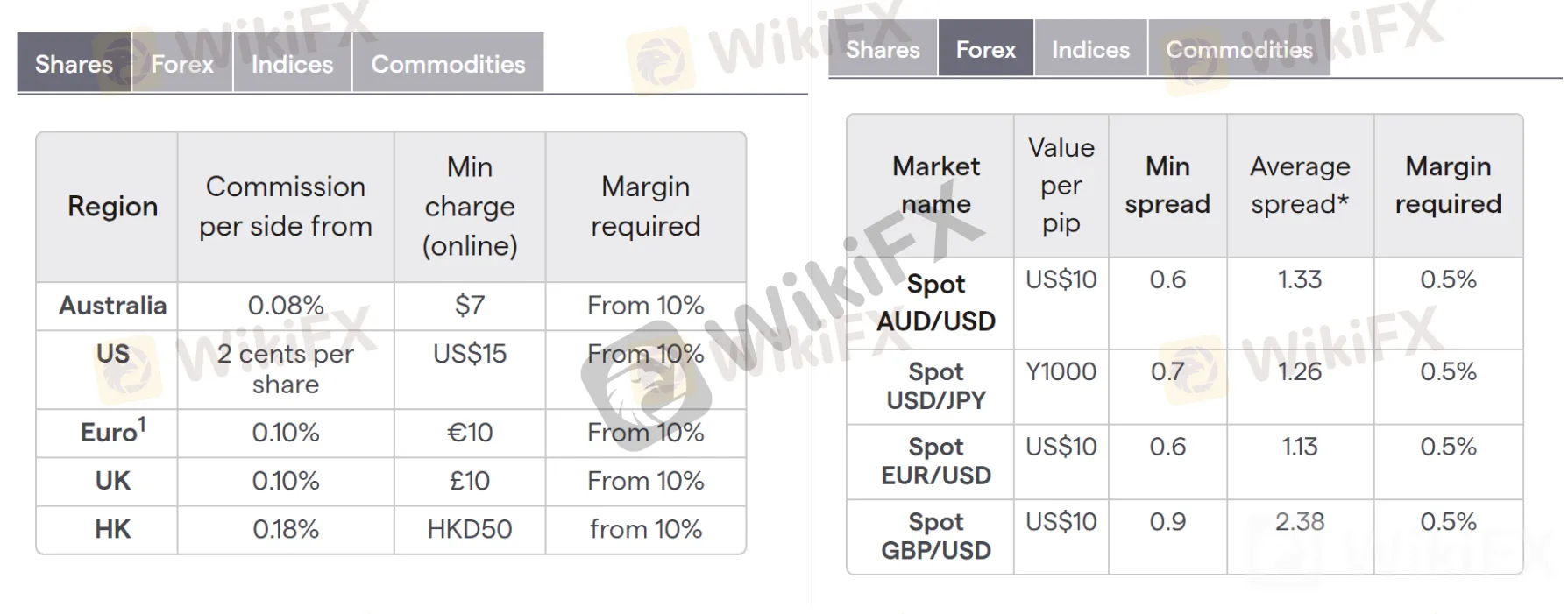

FXTrading.com Overview

According to research in South Africa, FXTrading.com is an Australian company founded in 2009 with headquarters in Sydney, Australia. FXTrading.com is an Australian foreign exchange trading (FOREX) brokerage firm, regulated by: The Australian Securities and Investments Commission (ASIC) and The Vanuatu Financial Services Commission (VFSC)The company originally opened in Australia due to the strong financial, economic, and political landscape, as well as Australia’s highly regulated financial sector and long-term track record.To get more news about fxtrading.com review, you can visit wikifx.com official website.

FXTrading.com does not offer a sign-up bonus. However, traders who register a real account with FXTrading.com are eligible for a 10% deposit bonus which also counts as a welcome bonus.

Traders who deposit between $1,000/R16 000ZAR up to $50,000 are offered a 10% bonus up to a maximum of $5,000/R80 000ZAR. This bonus is paid into the trading account as trading credit and can therefore not be withdrawn.

FXTrading.com charges a minimum deposit amount of $100. This minimum deposit is the average that most brokers charge, The minimum deposit required is equal to R1 600 ZAR at the current exchange rate between the US Dollar and the South African Rand.

The Standard Account is an entry-level account that is offered by FXTrading.com which caters to most traders. This is regardless of whether traders are beginners or more experienced traders who do not yet qualify as professionals.

As a practice account for beginner traders who need to build up trading skills and experience. More experienced traders who wish to test out their strategies in a risk-free environment. As a way for traders to test out FXTrading.com’s offering before registering a live trading account.

Islamic Account

The purpose of an Islamic Account is that it caters specifically to Muslim traders who follow Sharia law. The law prevents its followers from paying any type of interest, such as overnight fees, which is seen as wasteful or exploitive

Despite the popularity of Islamic Accounts amongst brokers, FXTrading.com does not offer this option to Muslim traders. This means that Muslim traders must ensure that they close all open trading positions before the trading day concludes.

Similar to a bank, to register a forex trading account with FXTrading.com for the first time, you will be required to go through a basic "know your customer” process, which will allow FXTrading.com to ascertain that your submitted details and ensure the safety of your funds and account details.

Step 1 – Start the process

In order for the applicant to start the process, they can simply click on the "Open Account” button on the FXTrading.com homepage.

How to open a FXTrading.com account step 1

Step 2 – Complete Registration

The second step in the account registration process is to complete a short and simple registration form with a full name, email, and password. Once the registration form has been completed, the applicant can accept the privacy policy and click "Continue”.

Step 3 – Download Platform

The third step in the account registration process is to download the trading platform and fill in the login details received in order to start trading

Posted by: freeamfva at

08:16 AM

| No Comments

| Add Comment

Post contains 519 words, total size 4 kb.

Lunar Pips Review

Is Lunar Pips Legit?

After taking a look at their website, it shows that they do not fall under any regulating agency. That is a MAJOR RED FLAG!! That should be enough for you NOT to invest with them. And they also work with websites that offer "Automated trading software” which is another red flag, as this kind of websites are infamous for scamming schemes.To get more news about lunarpips review, you can visit wikifx.com official website.

So, Lunar Pips is just another unregulated forex broker, which means the customers aren’t protected, and there is highly likely they will get away with your hard-earned money and there will be no regulating agency to hold them responsible.

How does the scam work?

Usually, unregulated forex brokers work in the following way. They will call people to persuade them to make the initial minimum deposit. And they will try any conceivable method in order to make that happen. They will offer deals that sound too good to be true. Like we will double your initial deposit or you will make $100 per day easily. Please don’t fall for anything they say!!! It is a SCAM! After making the initial deposit, they transfer clients to a smarter scammer, called a "retention agent”, who will try to get more money out of you. Also, one thing we need to add here is: don’t trust the good Lunar Pips reviews you might see online. They pay websites and services to improve their online reputation by posting good reviews about them.

Withdrawing funds

You should submit a withdrawal request ASAP, because your funds are never safe with an unregulated broker. And here is when things get tricky.

If you want to withdraw your money and it does not matter if you have profits or not, they will delay the withdrawing process for months. If they delay it for six months, you won’t be able to file a chargeback anymore and your money is gone for good. It doesn’t matter how often you remind them or insist in withdrawing your money, you will NOT get them back. And if you signed the Managed Account Agreement or MAA, which is basically authorizing them to do anything they want on your account, they will lose all your funds so there won’t be anything to request anymore.

How to get your money back Lunar Pips?

If you already deposited your money with them and they refuse to give your money back, which is very likely to happen, don’t worry, it might be a way or two to get your money back.

First of all, you need to keep the emails as proof that you have been requesting the money back from them but they don’t give it to you. Or they delay the process for too long, with the intention of not refunding your money.

The first thing you should do is perform a chargeback! And you should do this right away! Contact your bank or credit card provider and explain how they deceived you into depositing money for a non-regulated trading company. Mention also that they refuse to give your money back. This is the simplest way of getting your money back and is also the way that hurts them the most. Because if there are many chargebacks performed, it will destroy their relation with the payment service providers. If you haven’t done this before or you are not sure where to start or how to present your case to your bank or credit card company, we can assist you in preparing your chargeback case. Just contact personalreviews1@gmail.com but don’t let your broker know they you read this article or that you are contacting us.

What about wires?

If you sent them a wire, there is no way to perform a chargeback on a wire. For this step you need to raise the fight to a different level. Tell them you will go to the authorities and file a complaint against them. That will get them to rethink the refund possibility. Another thing you can do is prepare a letter or email for the regulating agencies. Depending on where you live, you can search google to find the regulatory agency for Forex brokers in your country. After that you can prepare a letter or an email describing how they deceived you. Make sure you show this letter or email to them, and tell them you will send it to the regulating agency if they don’t refund your money. If you don’t know where to start, reach us at personalreviews1@gmail.com and we’ll help you with this step as well.

Make sure you leave Lunar Pips reviews in other sites

Another way to hurt them and save other people from falling victims is to leave bad reviews on other sites. See what other sites have posted reviews about Lunar Pips, and describe shortly what happened. If you fallen victim, please leave a review and a comment on this site at the comment section. Also, when these people change their website, they tend to call the old clients. So, if they call you from a new website, mention it in the comment or let us know about it. That would be really appreciated by us by our users. Also, if you get phone calls from other companies, please put the name of these companies also in the comment. Or you can send them to us and we will expose them too.

Posted by: freeamfva at

07:59 AM

| No Comments

| Add Comment

Post contains 915 words, total size 5 kb.

TENX PRO XSTRIKE REVIEW

I have been testing the new 300g and 315g Xstrikes from TenX Pro for a few weeks. Here is my TenX Pro Xstrike Review.To get more news about tenx review, you can visit wikifx.com official website.

Introduction

I got two demos for this TenX Pro Xstrike review – they have the same mold and layup, but different weights, balance points, and swing weights. The technology in the racquets is called Uniflex – meaning that the racquet flexes uniformly. You can watch the below video from the TenX website explaining the technology and the thoughts behind it.

There is no balance point listed on the frames or the website, but based on my readings it is supposed to be 7 pts HL or 32 cm unstrung.

I think it would have been interesting if they offered more of a difference between the two models. If you are a player who wants a 315g unstrung weight, you are likely also open to customizing the 300g. My suggestion would be to do one 295g and one 310g, where the heavier one is called Xstrike Tour or Pro and has an 18×20 string pattern or a thinner beam. Just to create more choices available to the consumer.

Tenx Pro is a pretty new brand and a small, family-run company. The racquets they produce are of high quality. The paint is durable and the overall composition and construction of the frames competes well with large-scale brands.

The racquets come with a synthetic grip. Another thing to point out is that the butt cap doesn’t have a trapdoor for easy weight customization. I think that’s something to look into for the future.

Player profile

The Tenx Xstrike racquets are for players looking for some free power and spin, but with a bit more control and comfort than what is currently most common in the market.

If you are a beginner or an under-13 player, I would consider the 270g or 285g versions they have on the website. The 300g option is suitable for intermediate to advanced players and the 315g would only be suitable for high-level competition players with excellent footwork, physique, and technical abilities.

These racquets are best for aggressive baseliners who like to control the point from the back of the court. You need to hit with a decent amount of top-spin to get the most out of these racquets.

First of all, I want to point out that I appreciate the lower stiffness rating of the Xstrikes. This is not something you find in a Babolat Pure Drive, Dunlop FX 500, or Wilson Ultra for example. I had no arm issues playing with each of these racquets and that’s a good thing for a so-called power/tweener frame.

The power level is not quite as high as the racquets mentioned above, but I think it is sufficient for most players. If you want more power or depth on your shots, you can always string with a hybrid or a softer poly at a lower tension.

The spin potential is very good with these frames as the pattern is quite open. They remind me of the feel and performance of the first edition of the Babolat Pure Drive that was released in 1997 (this is a good thing). I hit a flatter ball and like to get to the net, so they have a bit too much launch for my liking. But if you enjoy Pure Aeros or HEAD Extremes, you should definitely give the Xstrike a try. As it is a more comfortable racquet but competes well with both of these racquet lines.

This Tenx Pro Xstrike Review was generally a positive experience. This racquet does not suit my playing style or preference really, but it compares really well with most frames in this category. If I was a baseline player looking for a racquet to give me spin and power, this one would be a the top of my demo list along with the Dunlop SX, the Pure Aero and the HEAD Extreme line.

There is no doubt that Tenx Pro create nice frames. There is nothing in the experience with these frames that would be substandard to any other brand out there. Still, their racquets retail at a significantly lower price. So for players looking for a racquet to give them some free power and spin but without the arm issues that sometimes follow thick-beamed and stiff racquets, the Tenx Pro Xstrike is definitely worth considering.

I was a big fan of the control player-oriented Tenx Pro Xcalibre and that frame suits more my game and preference. But for players who like to take big cuts at the ball from the baseline, the Xstrike is the way to go.

Posted by: freeamfva at

07:48 AM

| No Comments

| Add Comment

Post contains 795 words, total size 5 kb.

XPro Markets Review – Things you Should Know about the Platform

It is a registered CFDs brokerage firm that aims to meet the demands of every trader no matter their experience level. Whether you’re a novice or a professional, XPro Markets offers traders the chance to trade in over 160 different CFDs, including FX, equities, indices, commodities, as well as cryptocurrency futures, all of which may be traded with a customized account.To get more news about xpro markets review, you can visit wikifx.com official website.

XPro Markets is far more than merely a typical brokerage firm. Over the past few months, since its launch, it has worked tirelessly to cultivate the world’s best financial traders.

The psychology of trading extends much beyond what the average person realizes. It’s more than simply directing traders on when and where to place a trade; it’s a whole lot more complicated than that.

Becoming calm enough to make a good analyses trade is the beginning and the end of a sound trading mentality. Nobody can make money in the financial market if they’re apprehensive, nervous, or unsure of themselves.

XPro Markets offers multilingual phone calls, email, and live chat support along with extraordinary educational resources for its customers so that they may rest their heads on solid rock. Knowing that the platform is always looking out for them relieves a lot of strain.

XPro Markets has four different types of trading accounts that users may choose from when signing up for the service. Classic, Silver, Gold, and VIP memberships are available to users based on their trading interests, wallet size, and overall trading philosophy.

A desktop trading software and a web-based trading application are both available to XPro Markets users who use the Metatrader 4 trading software. XProMarkets employs the conventional Metatrader 4 trading applications for both Android and iOS mobile devices. They provide a broad range of financial assets to trade, such as foreign currency pairings, indices, commodities, cryptocurrency futures, and CFDs for stock trading.

It is possible to use up to 400:1 leverage with initial spreads that vary from 0.9 pips to about 2.8 pips. In order to put your trading techniques and the platform to test, you have the option of opening several demo trading accounts; however, before doing so, you will be required to authenticate your profile. A minimum deposit amount of $250 is required to open a basic account, and there are four other kinds of trading accounts available to customers.

XPro Markets trading accounts may be customized to fit the risk tolerance and overall trading strategy of each trader. This gives its users the freedom to customize their trading experiences and learn about some of the most prominent CFDs available in the market.It is crucial to have the backing of your brokerage firm at all times throughout the course of your everyday trading. The platform customer service staff is accessible around the clock to help you navigate the ever-evolving market, XPro Market has your back at all times.

The ever-changing market circumstances need tenacity and skillful trading.

In order to help you, the broker has a trader-centric strategy that focuses on delivering educational tools.

Posted by: freeamfva at

07:39 AM

| No Comments

| Add Comment

Post contains 537 words, total size 4 kb.

FXChoice (FX Choice) Review 2023

FXChoice was established in 2010. The broker is licensed by the International Financial Services Commission of Belize (FSC) and provides quality brokerage services for active and passive trading on the Forex market. FXChoice enjoys popularity among Western traders thanks to the broker’s commitment to business integrity, focus on customers, and to high requirements for its global employees. In particular, in 2019 the broker received the LiveHelpNow’s Exceptional Customer Service award every month of the year!To get more news about fx choice review, you can visit wikifx.com official website.

I use FXChoice for its low spreads and its license. In the five years of trading on Forex, I have worked with many brokers, including highly promoted ones. In reality, their "beneficial” conditions turned out to be fake: the spreads regularly expanded to 2-3 or even 5 points. In this regard, FXChoice is truly beneficial, because the spreads really do start from 0.5 pips. There have been no issues with withdrawals. The money is not accrued to the electronic wallets instantly, but it is accrued within an hour. All commissions specified on the website are real. I withdraw funds to Neteller, where there are no commissions at all.

FXChoice offers good trading conditions. The spreads and swaps are indeed low, the partnership program is beneficial and the loyalty program is good as well. Withdrawal is not very quick: wire transfers take 4-5 days. However, the broker does allow you to withdraw money, so it’s worth the wait. I’d also like to say a few good words about customer support. The operators provide quick and detailed responses. I plan to continue trading with FXChoice.

I wouldn’t say that FXChoice offers the best conditions for beginners. Maybe it is different for Western traders, I don’t know, but a $100 deposit is too high for me. The broker does not offer cent accounts, which is why you have to risk a large amount right away, whether you like it or not. There are too few permitted advisors for scalping. To copy traders with Myfxbook, a trader must have $1,000 on the account! These conditions are definitely not suitable for me, although it seems to me that the professionals will feel rather comfortable with this broker.

FXChoice is committed to providing quality services for active and passive trading. For this reason, the company continuously expands its arsenal of trading instruments and services for automated trading. The customers are offered classic accounts, and professional ECN accounts with tight market spreads. The broker is licensed by FSC, a regulator with strict rules.

The trading conditions of FXChoice are primarily suitable for experienced traders. The broker does not offer cent accounts, zero spreads, or optimal leverage for beginners. The broker provides a demo account option, but the account validity is limited to 90 days. The loyalty program with rebate and reduction of commission per lot is also designed for professional customers with high trading volumes, from $10 million.

The company’s website is localized in 8 languages. Customer support operators answer in English. For this reason, mainly Western investors use the broker’s services.

FXChoice has developed conditions for active trading and passive investment. The company offers several copy trading services and also allows the use of automatic trading advisors. The broker provides an opportunity to open a MAM account, which is similar to a PAMM account, where each investor can transfer their deposit to a professional trader to manage. The profit is accrued to the investor’s account minus the manager’s fee.

FXChoice aims to become a leader in online trading by providing several instruments for automatic trading. They allow investors to connect to the accounts of more experienced traders and copy their trades without personal involvement. If a trader is successful, the investor pays the trader a predetermined fee out of his profit. The company’s VPS server is compatible with most copy-trading services. The broker offers the following:

Automatic trading systems provide an opportunity for traders with all levels of experience to trade automatically. Automated trading is suitable not only for novice traders on Forex but also for busy customers who do not have the time or desire to trade independently. A broker’s customer can connect the services either in the trader’s personal account or directly on the trading platform.

Posted by: freeamfva at

07:27 AM

| No Comments

| Add Comment

Post contains 720 words, total size 5 kb.

Bold Prime Comprehensive Review — All You Need To Know

Bold Prime is among the most popular forex brokerages today. The company was founded in 2021, and the headquarters are in Saint Vincent and the Grenadines. The company has been providing quality services to its clients and has earned a good reputation. The company is also highly regulated and offers a leverage range of up to 1:2000.To get more news about bold prime review, you can visit wikifx.com official website.

The company also supports multiple currencies, which is a big plus for traders who want to trade in different currencies. They offer the support of MT4 and MT5 platforms, and the tradable instruments include forex, stocks, and indices. Customer support is available from 9:00 AM to 5:00 PM (GMT+2).

The company doesn't provide any information about the number of active clients or whether they are publicly traded. However, they offer a demo account to their clients, which is a big plus. In addition, the minimum deposit is $15, which is relatively low compared to other brokerages.

Bold Prime can be an excellent choice for forex traders looking for a reliable brokerage. The company offers a wide range of features and services that meet the needs of even the most demanding trader. Bold Prime has yet to receive its regulatory license from authorities, but it operates with an offline license in Saint Vincent and the Grenadines.

As mentioned earlier, the Bold Prime broker has not received its regulatory license yet. However, they operate with an offline license in Saint Vincent and the Grenadines. In addition, they have taken all the necessary measures to ensure that the platform is safe and secure when it comes to security. For example, they use SSL encryption to protect their clients' data and have a strict anti-money laundering policy in place.

With Know Your Customer (KYC) and Anti-MoneyLaundering (AML)compliance, the Bold Prime platform has employed the latest security technologies to protect its clients' information. KYC and AML are essential for clients' safety as they help prevent fraud and money laundering.

Bold Prime has implemented all the modern data security technologies for protecting clients' sensitive data, like two-factor authentication (2FA) and encryption. The 2FA adds an extra layer of security to the login process by requiring the user to input a code sent to their mobile phone. As a result, it is impossible for hackers to access the account even if they have the password.

Within a short period, the company has gained the trust of its clients and has become one of the most popular forex brokerages today. The company offers a leverage range of up to 1:2000, and they also support multiple currencies, which is a big plus for traders. In addition, bold Prime provides secure ways to deposit and withdraw with a minimum deposit of only $15.

Bold Prime broker fees information

Bold Prime offers multiple trading account types, each designed for a different profile of traders, and the fee structure varies as per profiles. The spreads offered by Bold Prime also vary by the account types, and they start from 0.1 pips and go up to 1.8 pips. In addition, bold Prime offers multiple ways to deposit and withdraw, including credit/debit cards, bank wire transfers, and e-wallets.

The deposit and withdrawals take around two to four business days to complete, which is slow compared to other brokerages. There is no information available regarding deposit and withdrawal fees at Bold Prime. You need to contact the Bold Prime support team to know more about their deposit and withdrawal fees. However, you need to pay the third-party fees your banks will charge for the transactions. Bold Prime offers leverag up to 1:2000, which is quite high compared to other brokerages.

Spreads fees information of Bold Prime broker

Bold Prime offers four trading accounts, and the spreads vary according to the account type. The minimum spread is 0.1 pips, and the maximum spread is 1.8 pips. They also charge commissions on a per-lot basis, and it starts from $0.7 and goes as high as $7 per lot.

They've not mentioned whether the spreads are floating or fixed. The spreads are slightly higher than other brokerages, but they are still competitive. You need to pay the commissions on all your trades, which can add up over time. Bold Prime offers leverage up to 1:2000, which is on the higher side when compared to other brokerages. It can be both good and bad, depending on your trading strategy.

Swap fees details at Bold Prime

You need to pay a swap charge for holding your position overnight. The swap charges at Bold Prime vary according to the currency pairs you trade. They've not mentioned the exact swap fees they will charge against your positions. So, you need to contact the Bold Prime customer support team to know more about the swap fees.

For Muslims, they also offer a swap-free Islamic account. In addition, there is no interest charged on positions that are held overnight in Islamic accounts. The company also offers a demo account to its clients, which is a big plus.

Posted by: freeamfva at

07:16 AM

| No Comments

| Add Comment

Post contains 863 words, total size 5 kb.

BDSwiss Review

Since its inception in 2012, BDSwiss has stormed the online trading scene with its carefully curated mix of products and services designed with a range of clientele in mind. 1.5M+ Registered Accounts $84B+ Trading Volume (Avg. Monthly Trading Volume) Clients from 186 Countries. BDSwiss goes the extra mile by hosting ample educational resources, providing up-to-date market research, and supplying exemplary customer support.To get more news about bdswiss review, you can visit wikifx.com official website.

Beyond support, educational resources, and regularly posted analysis, BDSwiss supports the advanced tools desired by both professional traders and institutional clients. Additionally, the inclusion of services like Autochartist, professional fund management solutions, real-time alerts, and VPS connectivity ensures that all its clients come to market armed with all the right resources. From raw variable spreads that can start as low as 0.0 pips to institutional grade liquidity and rapid execution, traders of all levels will be able to enjoy and appreciate the exceptional value that BDSwiss delivers.

Who Is BDSwiss Recommended For?

Thanks to an exceptionally well-rounded platform that focuses on supplying superior execution and competitive pricing, all manner of investors will be able to find value across BDSwiss’ offerings. Experienced traders can appreciate familiar tools like MetaTrader 4 and MetaTrader 5 along with straight-through processing execution and regularly updated market news.

Newcomers seeking more experience are also welcome to the platform thanks to demo accounts, low starting deposit amounts, extensive educational courses available through the Trading Academy and even daily webinars designed to keep traders informed of daily changes in market conditions.

Top BDSwiss Features

Award Winning Trading Conditions: Between extremely narrow starting spreads to institutional grade liquidity and robust tools, BDSwiss provides excellent conditions. The broker has been recognized for its excellent offerings by World Finance, which presented BDSwiss with the Best Trading Conditions award for 2019. We also won this award for 2020.

Institutional Grade Liquidity: BDSwiss endeavors to provide traders with the very best possible trading ecosystem, which extends to its exceptional liquidity strategy. Traders are invited to access ultra-low spreads, stunningly fast execution, and deep liquidity from top-tier providers for all assets available through the platform.

Live Market Coverage: Keeping traders informed is one of BDSwiss’s best features, with significant effort devoted to providing live market analysis through daily webinars, real-time trading sessions during key events as they unfold, and daily trading alerts.

Complimentary Analysis Tools: BDSwiss clients gain access to a treasure trove of resources, including complimentary analysis tools like Autochartist, correlating signals, VIP trading alerts, and exclusive webinars. In addition, educational materials that include video courses ranging from beginner topics to advanced subjects round out a well-designed investor ecosystem.

BDSwiss Compliance & Regulation

Delivering award-winning services to clients from 186 countries begins with the robust compliance process BDSwiss has put in place. The evidence is clear right from the registration phase thanks to a verification process that includes the normal proof of identity and proof of address documentation before registrants complete an appropriateness test and economic profile to determine suitability. Apart from complying with strict anti-money laundering rules, BDSwiss Holding PLC is also a member of the Financial Commission, which entitles clients to up to EUR 20,000 in compensation through the Investor Compensation Fund if disputes lodged are mediated in their favor.

In addition to its compliance practices and investor protections, BDSwiss is regulated by the Mauritius Financial Services Commission, and registered with the United States National Futures Association. Although US clients are still not eligible to join the platform, the latter regulatory license could pave the way for US clients to join this online trading platform in the future. All client funds are kept separate from BDSwiss’ operational funds in segregated accounts, adding an extra layer of security. Ultimately, BDSwiss regulatory licensing assures clients that they are trading in a safe and reliable ecosystem that protects their interests.

Posted by: freeamfva at

07:08 AM

| No Comments

| Add Comment

Post contains 644 words, total size 5 kb.

Warren Bowie and Smith Review – The Pros and Cons

In today’s time, online trading has emerged as a rage across the globe. Now, with CFD trading being a popular option, many investors in the UAE have embraced it as a lucrative option. CFD, which stands for contract for differences, is a financial derivative where the demarcation between the open and close trading prices are decided with a cash settlement. Unlike the conventional trading options, no physical goods or securities are provided with the CFD.To get more news about warren bowie smith review, you can visit wikifx.com official website.

CFD stands as an advanced trading strategy and is the first choice of most traders. It is banned in some countries like the USA, but not in the UAE. Through CFD, investors are supposed to trade over securities and commodity products. CFD traders focus on the price movement of derivatives and securities.

Which Countries Allow CFD Trading?

Contrary to popular belief, CFD trading is banned in the US. However, they are allowed in many other countries such as Germany, the United Kingdom, Singapore, Switzerland, France, Spain, New Zealand, Canada, Norway, Italy, Belgium, Denmark, Thailand and the Netherlands. CFD trading is fully legal in the UAE.

As far as Australia is concerned, the country that allows for CFD contracts, the Investment Commission and Australian Securities has announced many changes and the distribution of CFD to the current clients.

On the other hand, the Security and Exchange Commission has strictly forbidden the use of CFD, but non-residents will trade them without any constraints or reservations.

In this guide, we will shed light on an honest review of the firm and discuss the pros/cons of using it. So do you want to go on this ride to know everything about their firm? We’ve got your back and will educate you about everything related to their platform.

What is Warren Bowie and Smith?

In simplest terms, Warren Bowie and Smith is a broker for cryptocurrencies, forex, CFDs and ETFs. As of now, they have built a top-notch trading platform that is a benchmark in its own way. With years of experience and detailed knowledge of the industry, they provide learning and trading like a hand in glove with each other. They offer trading in CFD on indices, shares, cryptocurrencies and Forex, which is seldom heard of. As a result, you can assume control over profit and take the revenue to the next level.

How Does Warren Bowie and Smith Stand Out?

The reason why Warren Bowie and Smith stand concrete on their stance Is that they are specialized in CFD. While sifting through their positive reviews online, you will get to know that their platform is according to the latest standards, and you can even begin with a low deposit.

The reviews prove that Warren Bowie and Smith are some of the most popular CFD brokers not just in the west but in the UAE. Because they are listed in the stock exchange, too, you can rest assured about working with them. Because it takes less than a few minutes for a new account to open, newbies don’t have to struggle with waiting for too long.

A Top Notch Modern Investment Platform Warren Bowie and Smith

As already discussed, Warren Bowie and Smith are some of the leading CFD trading platforms on the web. It is chanted as a modern investment platform because of its mind-boggling website design and top-notch features.

As soon as you visit the landing page of the platform, you will be provided with "Join Now”, which will eventually take you to another page asking for your registration details. Secondly, the platform is created in a way that gives a seamless experience to the user.

Posted by: freeamfva at

06:51 AM

| No Comments

| Add Comment

Post contains 633 words, total size 4 kb.

Dominion Markets review

Dominion Markets is hard to pin down, at first, but then we have reviewed thousands of brokers. This one should not pose a risk. Of course, it didn’t. It’s a shady brokerage that has finely concealed its wrongful intentions behind a wall of lies. It’s the same old story told for the thousandth time. And we will say to our readers the old saying: do not invest here before reading the review, for you will regret it in the end.To get more news about dominion markets review, you can visit wikifx.com official website.

We registered pretty easily, and everything went surprisingly smoothly. Another surprise was the cool user area, that we did not expect to see. We even proceeded to open a live MT5 trading account. Here, we get a glimpse of the scammer nature of the broker. It is considered very suspicious to allow users to open a live trading account without the need to first provide legit ID confirmation docs. Just about anyone can open an account with Dominion Markets, and this is not good news.

Anyway, we opened a live account and were welcomed by a EUR/USD spread of 2.6 pips. No, Dominion Markets’ cost of trade for this popular asset is not worth it. It’s too high, making it rather unlucrative. The leverage was capped at 1:500. Traders can trade with forex currency pairs, metals, commodities, shares, and cryptocurrencies.

DOMINION MARKETS REGULATION AND SAFETY OF FUNDS

All legal things are governed by the laws of Saint Vincent and the Grenadines. This is what we find in the terms and conditions.

Some time ago, Saint Vincent and the Grenadines released an official statement in which the nation’s official revealed that the country has no FX regulator. Out of the thousands of brokers registered in the country, none are regulated to operate their FX services there. In other words, Dominion Markets is not regulated in the country. This is what matters. The claim that the governing laws are of SVG nature is irrelevant.

Other than that, we got acquainted with the common claim that users can trade with Dominion Markets only if their local jurisdiction allows them to do so. This is misleading at best. Local jurisdictions do not allow or disallow users from trading. Local regulators do that, but even then they prohibit the broker from operating in the country, and not the user from accessing the broker.

What we have on our hands is nothing more than another UNLICENSED broker. Dominion Markets is a risk to all investments.

We find it completely useless to invest in an unregulated broker. All investments will be lost! Always rely on regulated brokers, either from the FCA or CySEC, or the CFTC/NFA, or any other trustworthy license issuer. All these overseers keep record of the brokers’ activities, demand from them reports, require to keep the market integrity stable, and above all, call for the safety and security of all users, their funds and personal details. The FCA and CySEC are special in that they offer client compensation schemes which are applied to users whose brokers cannot pay them back due to financial predicaments. CySEC offers a €20 000 refund amount per person, while the FCA guarantees up to £85 000.

The MT5 is the best platform in the industry, allowing users to expand their trading knowledge with each hour of usage. However, it is not enough to redeem the broker.

There is a $3.5 commission per side for pro account users. This adds up to a $7 commission, which increases the spread (to whatever asset the commission applies to) for pro users with 0.7 pips.

DOMINION MARKETS DEPOSIT/WITHDRAW METHODS AND FEES

The user area reveals the three payment categories: credit and debit cards, wire transfer, and crypto wallets. The minimum deposit is $100.

Withdrawals are said to be processed within 48 hours tops. From the client portal, we learn that users cannot withdraw funds using a wire transfer. All other methods are open.

We found no information on any withdrawal fees. Keep in mind that the broker is unregulated, and thus can easily afford to launch fees, any fees.

In conclusion, Dominion Markets is not worth the risk. You will lose your money if you invest in it, and all your ID details will be used against you.

Posted by: freeamfva at

06:40 AM

| No Comments

| Add Comment

Post contains 724 words, total size 5 kb.

PARAGON LED LIGHT STRIPS

Create inviting and immersive experience with our energy efficient LED strip lights – Features easy installation and added flexibility to bend, cut or extend light strip to fit your preference and requirements.To get more news aboutled bar decor, you can visit htj-led.com official website.

Endless possibilities with Paragon LED light strips, create a dynamic and inviting experience for your home, office, retail stores and etc…

Paragon LED light strip, is a versatile product due to the fact that it can be easily be cut on the given cut lines, allows you to customize it based on your preferred length and requirements.

Creating long and continuous illumination can be achieved effortlessly too when combined with an amplifier. It allows for uninterrupted line of illumination.

When taken straight out of its packaging, Paragon LED light strips are prewired on both end. Installation work is done in no time.

The controllers offer users with additional control such as dimming, preset ightness, color output and etc at a distance. Making minute adjustment to the light output of LED light strip can be done effortlessly.

Apart from being able to select the different type of color output, Paragon LED strip lights are also available in IP20 and IP67, for both indoor and outdoor installation.

LED strip lighting is one of the most popular lighting systems today, as it is high in energy efficiency and suitable for both residential and commercial installation. When installed correctly, LED strip lighting not only functions well as high-quality task lighting, but can also be used to provide better ambience during events or as innovative decor solutions for work and retail environments.

LED light strip is an all-rounder performer that can be installed anywhere, due to its flexibility in adapting and meeting different lighting requirements. LED strips are available in a wide range of colours, tones, colour temperature and ightness.

LED strips are thin in size and can be bend easily, making it easy to install in tight locations that are otherwise difficult to illuminate. Because they are so thin, you can also choose to display the

With LED strip lighting, you get to have full control over your lighting solution. You can cut the LED strip to length according to your space requirements, specify the colours and ightness, and select from different types of housing.

When it comes to LED strips, there is no one-size-fit-all solution – different projects and applications require different types of LED strips. Let us know what you need, and we will be able to customise your LED strip lighting to your exact requirements.

Posted by: freeamfva at

06:26 AM

| No Comments

| Add Comment

Post contains 436 words, total size 3 kb.

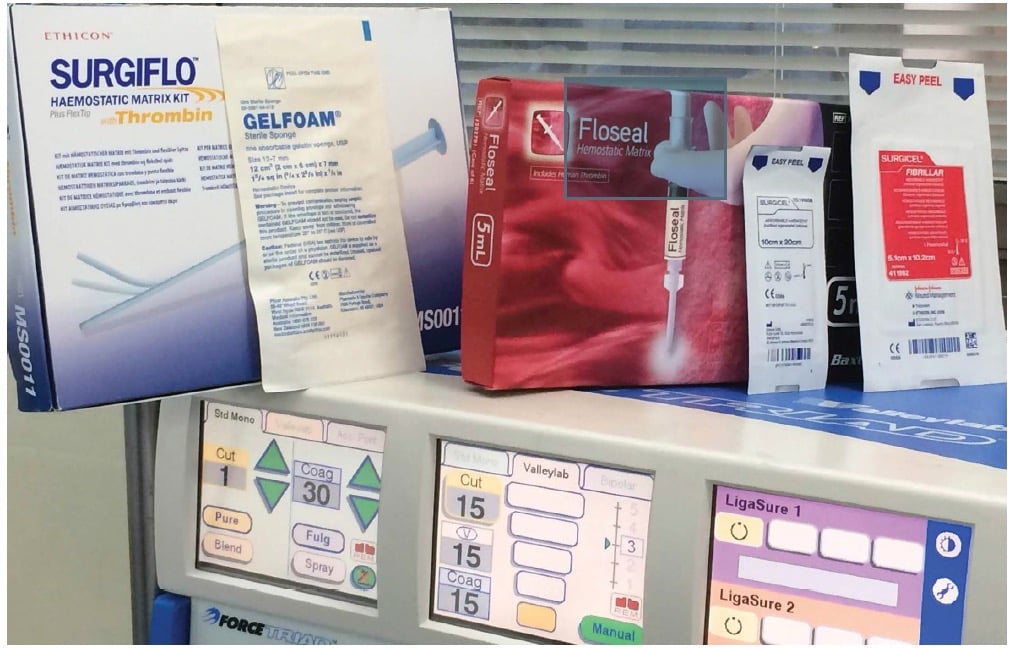

Global Disposable Hemostatic Agents

New Jersey, United States,- Our report on the Disposable Hemostatic Agents market provides you with a comprehensive overview of the current market trends and developments, as well as the latest insights into the competitive landscape. The report offers an accurate understanding of the market dynamics, such as the drivers, opportunities, challenges, and upcoming trends, to help you make informed strategic decisions.To get more news abouthemostatic dressing, you can visit rusuntacmed.com official website.

Furthermore, the report offers reliable analysis into the key market segments and regional analysis. Insights into production and consumption, as well as pricing and regulatory dynamics, are made available to help you gain a deeper understanding of the market dynamics. Additionally, the report provides invaluable information on the distribution channels, technologies, and industry relationships that are relevant to the industry. All these insights are provided to help you maximize your customer acquisition opportunities and reduce the risks associated with managing the industry.

The segmental analysis section of the report includes a thorough research study on key type and application segments of the Global Global Disposable Hemostatic Agents market. All of the segments considered for the study are analyzed in quite some detail on the basis of market share, growth rate, recent developments, technology, and other critical factors. The segmental analysis provided in the report will help players to identify high-growth segments of the Global Global Disposable Hemostatic Agents market and clearly understand their growth journey. Moreover, it will help them to identify key growth pockets of the Global Global Disposable Hemostatic Agents market.

The geographical analysis of the Global Global Disposable Hemostatic Agents market provided in the report is just the right tool that competitors can use to discover untapped sales and business expansion opportunities in different regions and countries. Each regional and country-wise Global Disposable Hemostatic Agents market considered for research and analysis has been thoroughly studied based on market share, future growth potential, CAGR, market size, and other important parameters. Every regional market has a different trend or not all regional markets are impacted by the same trend. Taking this into consideration, the analysts authoring the report have provided an exhaustive analysis of specific trends of each regional Global Disposable Hemostatic Agents market.

(A) The research would help top administration/policymakers/professionals/product advancements/sales managers and stakeholders in this market in the following ways.

(B) The report provides Global Disposable Hemostatic Agents market revenues at the worldwide, regional, and country levels with a complete analysis to 2028 permitting companies to analyze their market share and analyze projections, and find new markets to aim for.

(C) The research includes the Global Disposable Hemostatic Agents market split by different types, applications, technologies, and end-uses. This segmentation helps leaders plan their products and finances based on the upcoming development rates of each segment.

(D) Global Disposable Hemostatic Agents market analysis benefits investors by knowing the scope and position of the market giving them information on key drivers, challenges, restraints, and expansion chances of the market and moderate threats.

Posted by: freeamfva at

06:09 AM

| No Comments

| Add Comment

Post contains 504 words, total size 4 kb.

Shadow of slavery still looms over African Americans

It all started with 20 enslaved people who were brought from Africa to Virginia in 1619. They were followed by hundreds of thousands of African slaves who fueled the rise of the United States – many of them whipped, raped and killed for their skin color in the process.To get more news aboutShadow Slave, you can visit innread.com official website.

The majority of enslaved Africans were brought to British North America during the 18th century. At the time of the Declaration of Independence, slavery was legal in each of the newly created 13 states. Before the American Revolutionary War in 1775, slaves comprised about one-fifth of the population.

"The expansion of slavery in the first eight decades after American independence drove the evolution and modernization of the country … The South became a continental cotton empire, and the U.S. grew into a modern industrial and capitalist economy," historian Edward E. Baptist reveals in his book "The Half Has Never Been Told."

Throughout the colonial and antebellum periods, over 90 percent of African slaves lived in rural areas in the South, where they were forced to plant and pick thousands of pounds of cotton each day.

Deemed by European settlers as commodities, people were sold and bid on at auctions. Young Africans were taken from their families, pushed to the expanding territories of Mississippi and Louisiana. Women carried the burden of taking care of the families as well as spinning, weaving and sewing.

"The prevalence and long-term existence of slavery in the United States is a stain on American liberal democracy. It led to a huge division between the North and the South, which triggered the Civil War," said Wang Lixin, director of the Center for Modern & Contemporary European & North American History at Peking University.

The extreme exploitation from slavery generated huge profits for white slave owners. Before the American Civil War, cotton grown and picked by slaves in the American South became the country's most profitable export, accounting for roughly three quarters of the world's cotton supply, according to the Bettmann Archives.

"The slave trade changed the course of American history. Apart from being an important driving force behind the rise of the capitalist economy, it completely changed the demographics of the America," said Du Hua, associate professor at the School of History of Wuhan University.

Though the import of slaves from Africa was barred in 1808, domestic slave trade flourished till the 1860s, displacing approximately 1.2 million slaves.

"With the development of the industrial revolution in the 19th century, Western capitalism entered a new stage of free competition from the primitive accumulation of capital. That's one of the factors that drove out slavery," said Mu Tao, professor at the Department of History of East China Normal University.

Although slave trade promoted capitalist economy, it was destructive for Africa. The continent suffered a huge population loss following outbreaks of new diseases introduced by European slave traders, like smallpox, tuberculosis, pneumonia and syphilis.

"Europeans used guns, gunpowder, shells and luxury goods like Indian textiles and beads to exchange Black slaves, which contributed little to the local economy," added Mu, who is also vice president of the Chinese Society of African Historical Studies.

"On the contrary, many towns and villages in Africa were destroyed by guns and gunpowder used in the slave-hunting war, including Benin, a famous city-state in West Africa."

Posted by: freeamfva at

05:46 AM

| No Comments

| Add Comment

Post contains 577 words, total size 4 kb.

Screw pump stator rubber sheath materials and methods how to choose

Rubber material screw stator is easily damaged important parts, it must consider the extent of the stator tooth profile accuracy and correctness of the material selected design development, which directly determines the length of the stator life. The selected rubber material formulation must take into account what transport media (media composition and corrosive media, etc.) and the temperature of the medium, and a rubber hardness of the rubber in the medium expansion and ultimate strength. Performance rubber pressure injection after, not only to determine the stator life, and even affect the normal operation of the pump can, for example: transport of oil medium NBR must be selected, because many rubber impatience oil medium; conveying hot media should choose fluorine rubber.To get more news aboutscrew pump, you can visit hw-screwpump.com official website.

The stator rubber hardness is good or bad performance is extremely important indicator: It is based on the degree of resistance to the elastic surface that is perpendicular to the direction of the force of quantitative load quantification later he said. Our most commonly used Shore (A) hardness (measured standard GB / T 531-1983).

Usually choose hardness of rubber stator should consider: a medium containing particles should take lower, pure net media is desirable high hardness; low viscosity media, higher hardness may be appropriate:

Select the recipe of the stator rubber dynamic test to get a reliable basis for even though it is close to the hardness and physical properties similar to conventional, if the recipe is different, the results of the dynamic test is still a big gap.

The stator plastic material should be selected gum containing a higher rate and the low hardness of rubber material. Although the higher the hardness the better the resistance to deformation, but the permanent deformation is also greater. Therefore, from the overall performance, the better Rockwell hardness 65 ~ 70HR dynamic performance; with rubber permanent deformation rate is small.

Posted by: freeamfva at

05:35 AM

| No Comments

| Add Comment

Post contains 340 words, total size 2 kb.

Police arrest teen wearing bulletproof vest

A 19-year-old man wearing a bulletproof vest and a girl under the age of 18 were arrested Friday after a junior college southeast of Montreal was ordered to lock down.There were no reports of injuries or gunfire, Sgt. Jeremie Levesque with the police of St-Jean-sur-Richelieu, Que., told reporters. He said police were conducting a controlled evacuation of the college located about 40 kilometres southeast of Montreal.To get more news aboutbulletproof zone customer service, you can visit bulletproofboxs.com official website.

Levesque said police arrested a man wearing a "bulletproof vest” but would not confirm whether the suspect was enrolled at the college.

"Apart from the bulletproof vest, I don’t have any information on explosives or weapons,” Levesque said.

Quebec provincial police, he added, will help local police complete a sweep of the school. No one was injured, but a pregnant woman was to be transported to hospital as a precautionary measure, he said.

Police received a call around 9:40 a.m. about a man acting suspiciously on campus. Levesque said it was the man’s clothing that was particularly alarming. Police arrived at the college and arrested a 19-year-old man and a girl Levesque described as a "minor.” Videos circulating online showed that the arrests occurred outside the college in what looked like a parking lot.The junior college — Cegep Saint-Jean-sur-Richelieu — ordered students and staff to barricade themselves into closed rooms and to keep the lights off at the behest of the police department. Police established a security perimeter around the college and restricted access to the school.

Earlier on Friday, Annie Metivier, an interior design technician at the college, said that she and four others — a colleague and three students — barricaded themselves in her darkened office at about 9:15 a.m.

"I’m still barricaded, and we don’t know anything. We’re following the information on social media and from our friends outside,” Metivier said in an exchange through Facebook Messenger before noon."We’re fine yes, stressed but it’s fine. We just can’t wait for all of this to end,” she said. "I saw the police with their guns next to my office because I had to go back and lock a door that a teacher had unlocked adjacent to my office. They told me to ‘hurry, hurry up and lock yourself in,’ seeing the police with their weapons ready to shoot, it increases the stress.”

Posted by: freeamfva at

05:25 AM

| No Comments

| Add Comment

Post contains 405 words, total size 3 kb.

NEMO® SH Plus Hygienic Pump With Bearing Housing

The design with bearing housing and free shaft end allows universal use of all types of drives. The progressing cavity pump is particularly suitable for shear-sensitive, low to highly viscous, lubricating, non-lubricating, solid-loaden, solids-free, thixotropic, dilatant, abrasive or adhesive media. The hygienic design of the components and machines, as well as the cleanability of the system parts (CIP and SIP capable) are defined in a multitude of regulations. To get more news aboutprogressive cavity pump, you can visit brysonpump.com official website.

NEMO® pumps are designed, manufactured and tested in accordance with FDA (Food and Drug Administration) and EU-VO 1935/2004 (EU regulation on food contact materials). Furthermore, NEMO® hygienic and aseptic progressive cavity pumps comply with the regulations of the 3-A Sanitary Standard of the USA and are GOST-R (certificate of conformity for Russia).

Our service and support do not end with the purchase. From consultation, spare parts and maintenance to the repair and modernisation of your pump - we support you right from the start.

Thanks to our worldwide service network, we are ready for you around the clock in case of an emergency.

The basis of any Progressive Cavity Single Screw Pump is a power section which usually consists of a metal rotor (n-start external helix) and a rubber stator (n+1-start internal helix). Rotation of the rotor inside the stator creates sealed cavities that progressively move from suction to discharge side of the pump producing differential pressure.

Pumps of SOLTEC ® company Novomoskovsk Mechanical Plant are placed on most leading manufacturers of dairy industry in Russia, Ukraine, Belarus, Kazakhstan, Azerbaidzhan, Moldova, Georgia and countries of Baltic. SOLTEC ® horizontal and vertical food pumps transfer cream, yogurt, sour cream, melted cheese and other milk products. At the same time it helps to minimize the whipped effect and avoid the breaking of coagulums in milk products, but it is impossible to achieve while using other types of pumps.

Posted by: freeamfva at

05:16 AM

| No Comments

| Add Comment

Post contains 333 words, total size 2 kb.

Presidents Day sales on home security systems and devices

Presidents Day sales aren't just limited to big-ticket items like televisions and refrigerators. There are also plenty of sales on gadgets and tech that are worth considering, particularly if you're looking to invest in your home.To get more news aboutlock manufacturer, you can visit securamsys.com official website.

For instance, home security systems and devices can help protect your property from intruders and enable you to remotely monitor your home and provide alerts if there are potential gas leaks or fires.

You don't have to break the bank to get efficient home security systems. The cost of these tools varies based on your needs and the installation requirements. Fortunately, now is the perfect time to buy. Several companies, like Cove, are offering Presidents Day sales on systems that are worth exploring. There are plenty of benefits of high-tech home security systems, but peace of mind is top of the list.

If you're looking to protect your home, deter burglars, remotely monitor your home and get alerted to potential issues, then it's time to start your search. Here are some sales you can shop now.Once you answer all of these questions, Cove will suggest the different types of equipment you may want to buy (like a touch alarm panel, door sensor, etc.) and give you a breakdown of the cost of each plus shipping. You can also add professional installation and setup, starting at $99.

You'll then move on to monitoring, where you'll be given different plan options such as basic or premium, also known as Cove Plus. Cove's monthly monitoring costs range between $17.99 and $37.99, the company states online.

The basic plan has at least 10 different features included, from three-factor alarm verification to a direct line to a 24/7 monitoring team and more. Meanwhile, the premium plan offers at least 16 benefits, including cost-saving deals such as the first month free and 7 days of free cloud storage. There are no contracts and you can cancel anytime, according to Cove.

Posted by: freeamfva at

05:00 AM

| No Comments

| Add Comment

Post contains 349 words, total size 2 kb.

February 15, 2023

The broker has no minimum deposit and no inactivity fee whatsoever, which could make the platform well suited to those who just want to try their hand at forex trading.To get more news aboutbest high leverage forex brokers, you can visit wikifx.com official website.

As the broker is regulated by the FCA in the UK, leverage is limited to 30:1 for major currency pairs, and 20:1 for minor pairs.Meanwhile, professional forex traders can get leverage of up to 500:1 with Pepperstone’s professional account.

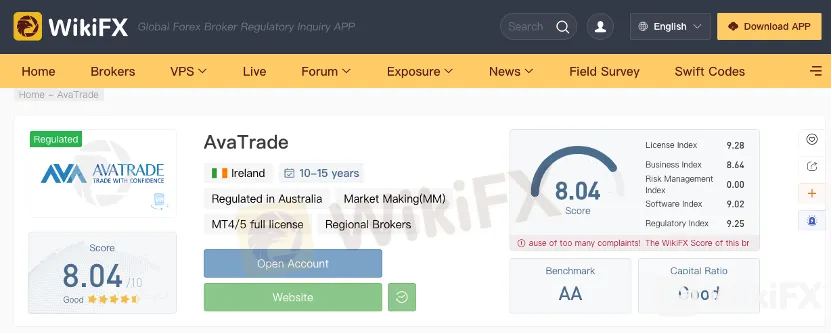

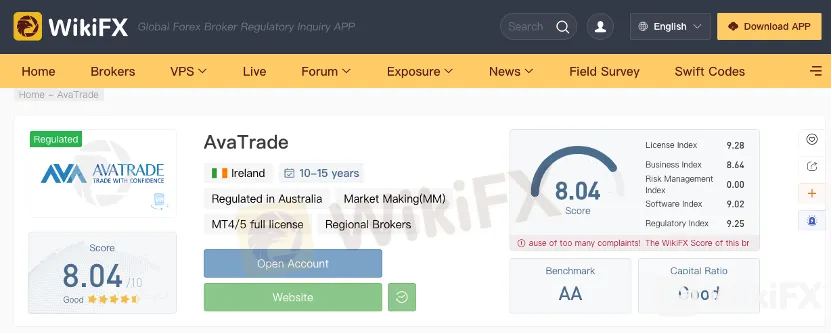

AvaTrade

Speaking of currency pairs, AvaTrade is a forex broker with slightly better offerings.Indeed, the broker has 55 currency pairs for you to choose from. However, it’s important to keep in mind that AvaTrade is not fully regulated by the FCA in the UK.

This doesn’t mean AvaTrade is unsafe – in fact, the broker is stringently regulated by several different regulatory bodies around the world, including the Central Bank of Ireland. However, you typically won’t receive any protection from the Financial Services Compensation Scheme (FSCS) in the UK should the broker cease operations.Despite not being fully regulated in the UK, AvaTrade still limits forex leverage to 30:1 for retail investors, though professional clients can get leverage up to 400:1 if they meet the qualification criteria.

There is a minimum deposit of $100 when you first open your account on AvaTrade, and you will be required to pay an inactivity fee of $50 a quarter after three months of inactivity, and a further fee of $100 after another 12 months.

ActivTrades

ActivTrades is a popular choice for forex trading.

Like most Financial Conduct Authority (FCA) regulated brokers, ActivTrades limits forex leverage to 30:1 for retail customers.

They do offer a professional account for qualified forex traders, though, where the leverage increases to 200:1. Only professional traders can access this higher leverage.While the trade cost with ActivTrades’ is relatively low at only $5.70, there is a minimum deposit of $10* when you first open your account.And, you will have to pay an inactivity fee of $10 a month after one year of account inactivity.

eToro

You may have heard of eToro before, and one of this popular broker’s offerings includes forex.

While eToro only has 49 currency pairs for you to trade, the minimum deposit amount of $10 when you first open your account is quite low.

FXTM

FXTM is another popular choice for forex trading. The broker is regulated in the UK by the FCA, meaning forex leverage is restricted to 30:1 for retail investors.

Meanwhile, if you’re a professional trader, you can access leverage of up to 2000:1 on FXTM.

IG

If you’re looking for a broker with a good selection of different currency pairs, then IG could be a good choice for you.Indeed, the broker has 205 currency pairs, making it the broker with the most pairs on this list.

It could also be a good platform for beginners too, as there is no minimum deposit, and the inactivity fee is only £12 a month after two years of inactivity.

Posted by: freeamfva at

06:35 AM

| No Comments

| Add Comment

Post contains 510 words, total size 3 kb.

Pepperstone has one of the best demo accounts as it allows you to practice with MetaTrader 4 (MT4), MetaTrader 5 (MT5) or cTrader forex trading platforms.To get more news aboutbest forex demo account brokers, you can visit wikifx.com official website.

MetaTrader 4 is the best choice of platform for a demo trading account, as it is considered the gold standard when it comes to trading platforms. This platform offers all the essential trading tools to familiarize yourself with trading such as 30 indicators, 31 graphical tools, 9 timeframes, automated trading, and social trading.

With over 60 currency pairs to choose from, all with ECN-like tight spreads, Pepperstone will help you minimize your trading costs. Pepperstone is known for its lightning-fast execution speed of 30ms on average which will help you avoid slippage and its award-winning customer service team, many of who are traders themselves. Traders can choose from their commission-free standard account and razor account with $7.00 commissions round-turn per lot.

Pepperstone’s demo trading account is ranked first due to the ease of setting up an account, a balance of virtual money to simulate live trading and access to an environment similar to ECN trading. You can view a complete review of Pepperstone. After familiarizing themselves with the platform and forex broker, users can sign up for a real money account and start trading forex and cryptocurrencies.

IC Markets demo account offers virtual forex trading on the world’s top trading platforms (MetaTrader 4, MetaTrader 5 and cTrader). Unlike most brokers which limit the virtual cash and time you can use the demo account, IC Markets allows you to choose how much virtual cash you wish to trade and the account will only be closed after 30 days of inactivity. IC Markets demo account is free, you don’t need to open an account (which requires a $200 deposit) to practice trading.

MetaTrader 5MetaTrader 5 (MT5) is the successor to MetaTrader 4 (which is widely considered the gold standard for platforms). MetaTrader 5 offers more technical indicators, graphical tools and faster processing than MT4. One notable difference is that MT5 is designed for decentralized and exchange-traded CFDs such as stocks. In time, this platform should become as popular as MT4.

IC Markets offers 64 currency pairs and an ECN-like environment with fast execution speeds and high leverage. Traders have a choice a standard account with no commissions and raw spreads account which has commissions of $3.50 side trip.

Plus500 is one of the world’s largest CFDs providers. The broker’s point of difference is an in-house developed trading platform to help traders take advantage of the wide range of CFDs available with ease. CFDs available in addition to the usual forex and indices include an extensive range of commodities including some rare options such as lean hogs, cattle, and 13 cryptocurrencies. Traders can also trade options, stocks, and indices for sectors such as cannabis, lithium, and real estate.

Plus500 does not charge commissions which means fees are included in the spread and include risk management tools such as negative balance protection and guaranteed stop-loss.

Oanda’s offers a choice of their in-house developed platform OandaTrade which is available as a web trader, desktop and mobile version and MetaTrader 4. With both platforms, your demo account will have 100,000 virtual units for trade which never expires.

Choosing Oanda gives you a choice of 2 retail investor account, the Premium account which is a spread only product and the Core account which has a commission of $7 per 1k round turn and ECN like trading execution.

FXCM allows you to choose from 4 trading platforms to demo. These include Trading Station, MetaTrader 4, Ninja Trader and TradingView. Trading Station is FXCM’s own proprietary trading platform which is the best option (along with MetaTrader 4)if you wish to use trading automation with FXCM automation and backtesting. NinjaTrader is the best option should you use to access advanced charting and trade management options. TradingView is the best option if you wish to practice social trading.

FXCM only offers one account, and this account is spread only meaning there are no commissions*. FXCM like to be open about their transparency, the broker publishes regular reports on their trading execution performance. In 2020 Q2 59.92% of orders had no slippage and 28.48% of orders had positive slippage.

Posted by: freeamfva at

06:25 AM

| No Comments

| Add Comment

Post contains 721 words, total size 5 kb.

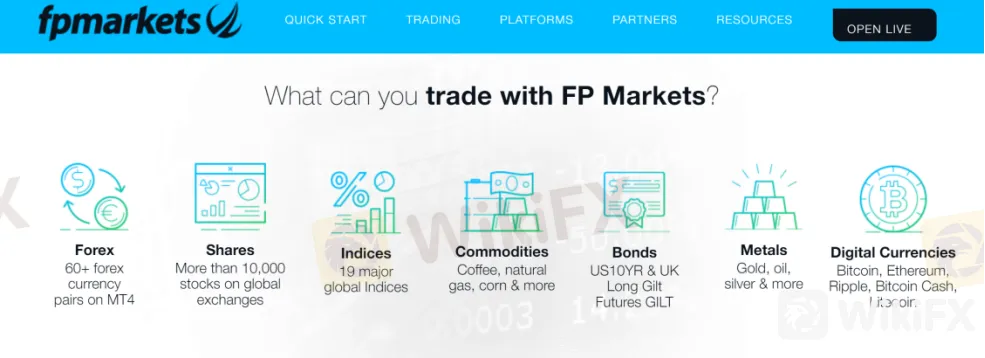

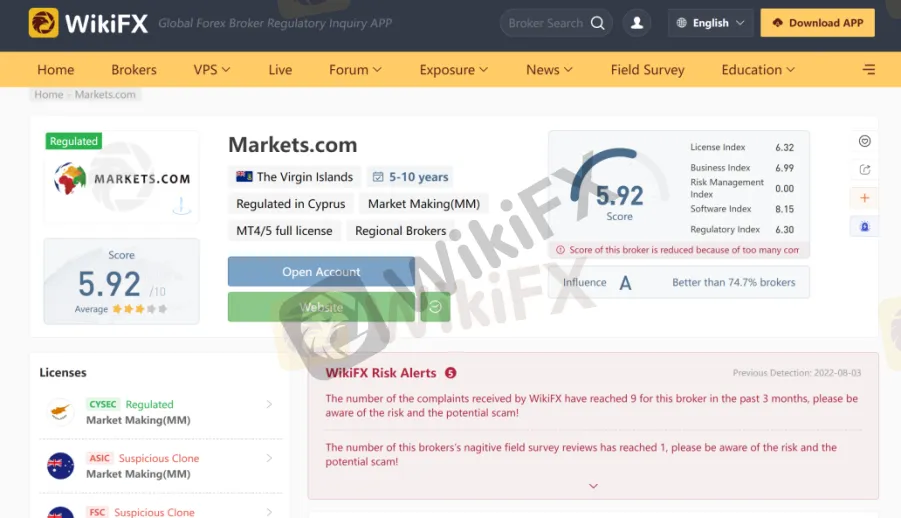

If you are interested in getting involved in the trillion-dollar a day foreign exchange market, then choosing a top forex broker is extremely important. Finding the best forex brokers in Thailand with the best commissions, fees, platforms and customer support can be difficult as well as time-consuming. This is why we have done the work for you!To get more news aboutbest forex brokers in thailand, you can visit wikifx.com official website.

In this Best Forex Brokers Thailand 2021 guide, we review some of the best forex brokers in Thailand so you can find the right one for yourself and get started with them today.

In the forex brokers list shown above, many of these entities are considered to be in the top 10 forex brokers in the world. This will become evident as we go through some of the core features and benefits of the services each broker provides.

Top Thailand Forex Brokers Reviewed

Since the pandemic, the interest in trading the foreign exchange market has surged. This has led to an increase in how many forex brokers there are in the world. Unfortunately, not every forex trading broker will be good.

How do you find the best forex broker in Thailand? Which Thai forex broker offers the best commissions and fees? Are they regulated to ensure your capital is safe?

Find the best Thai forex broker isn’t as easy as it seems. It requires detailed research, testing and analysis which can take some time. Fortunately, we have done this for you! Below we review the 5 best forex brokers in Thailand.

1. eToro – Overall Best Forex Broker in Thailand with Largest Copy Trading Service

etoro best forex broker thailandIf you want to trade with the best forex broker in Thailand then eToro should be at the top of your list. The broker boasts the best and largest social trading platform in the world with more than 20 million users.

If you’re not familiar with social or copy trading, it basically means that you can view the performance of other traders and have their trades copied onto your own account. It’s the fastest-growing trend in the forex industry and one you seriously want to think about – take a look at some of the results below.

2. VantageFX – Best Forex Broker for ECN Trading Accounts

vantagefx broker thailandVantageFX is considered one of the best forex brokers in Thailand for ECN trading accounts. ECN stands for ‘electronic communication network.’ It allows you to trade directly with the interbank market with no middleman, thereby accessing raw spreads.

3. Capital – Best Forex Broker in Thailand with Low Minimum Deposit ($20)

capital best forex brokers in thailandCapital is the best Thailand forex broker for beginner traders. To open an account you only need a minimum deposit of $20 to start trading on more than 3,000+ global markets including foreign exchange, stocks, indices, commodities and cryptocurrencies.

4. Libertex – Best Forex Broker in Thailand with Tight Spreads

forex broker thailand libertexLibertex is one of the best forex brokers in Thailand because it allows you to trade with tight spreads! The spread is the difference between the buy and sell price of an asset. It’s a cost every broker will charge – unlike Libertex which is considered a top-quality low spread broker.

5. AvaTrade – Best Broker for Account Types (CFD, Copy, Options)

avatrade forex broker thailandAvaTrade is one of the best forex brokers in Thailand due to the range of account types they provide. For example, you can trade forex from a CFD, options or copy trading account. The options trading account is particularly useful as it’s not provided by many brokers.

Posted by: freeamfva at

06:17 AM

| No Comments

| Add Comment

Post contains 615 words, total size 4 kb.

32 queries taking 0.0618 seconds, 133 records returned.

Powered by Minx 1.1.6c-pink.